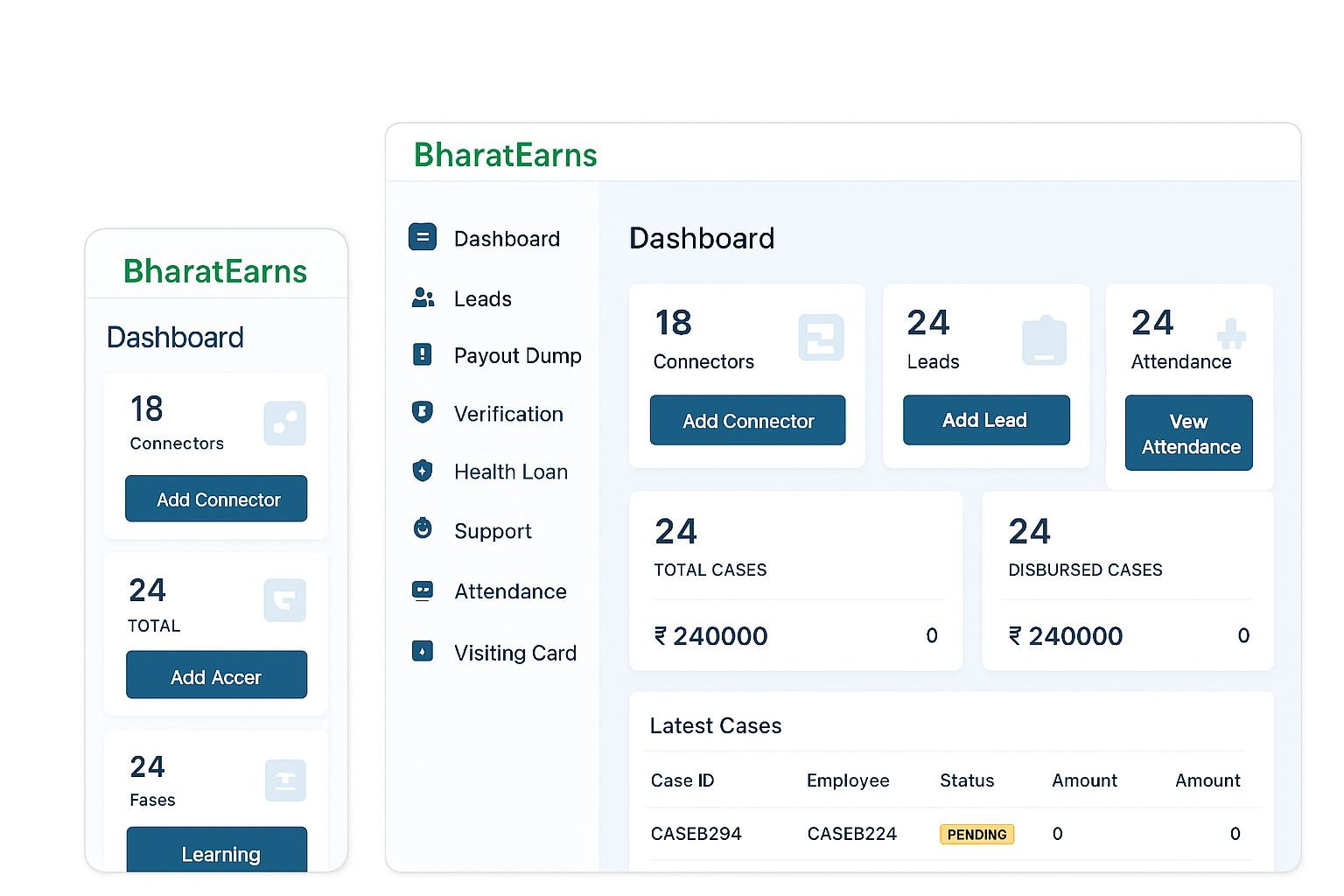

India’s First AI-Powered DSA CRM — Built for Loan Businesses

Automate sourcing, tracking, underwriting & payouts — all in one smart CRM designed exclusively for DSAs, lenders, and partners.

Certified