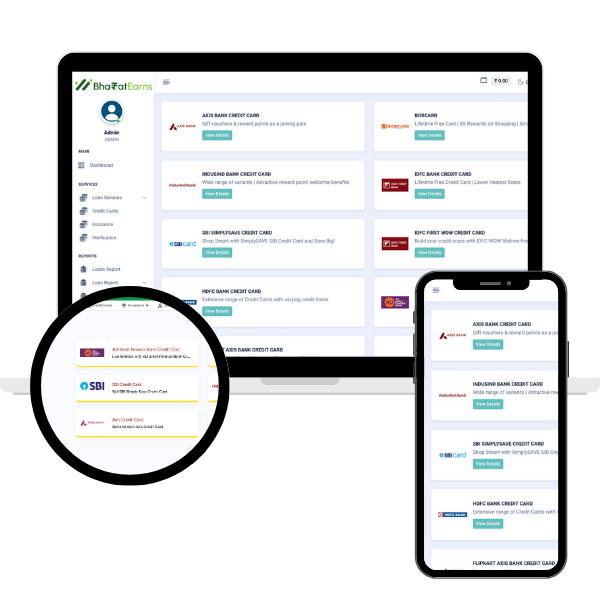

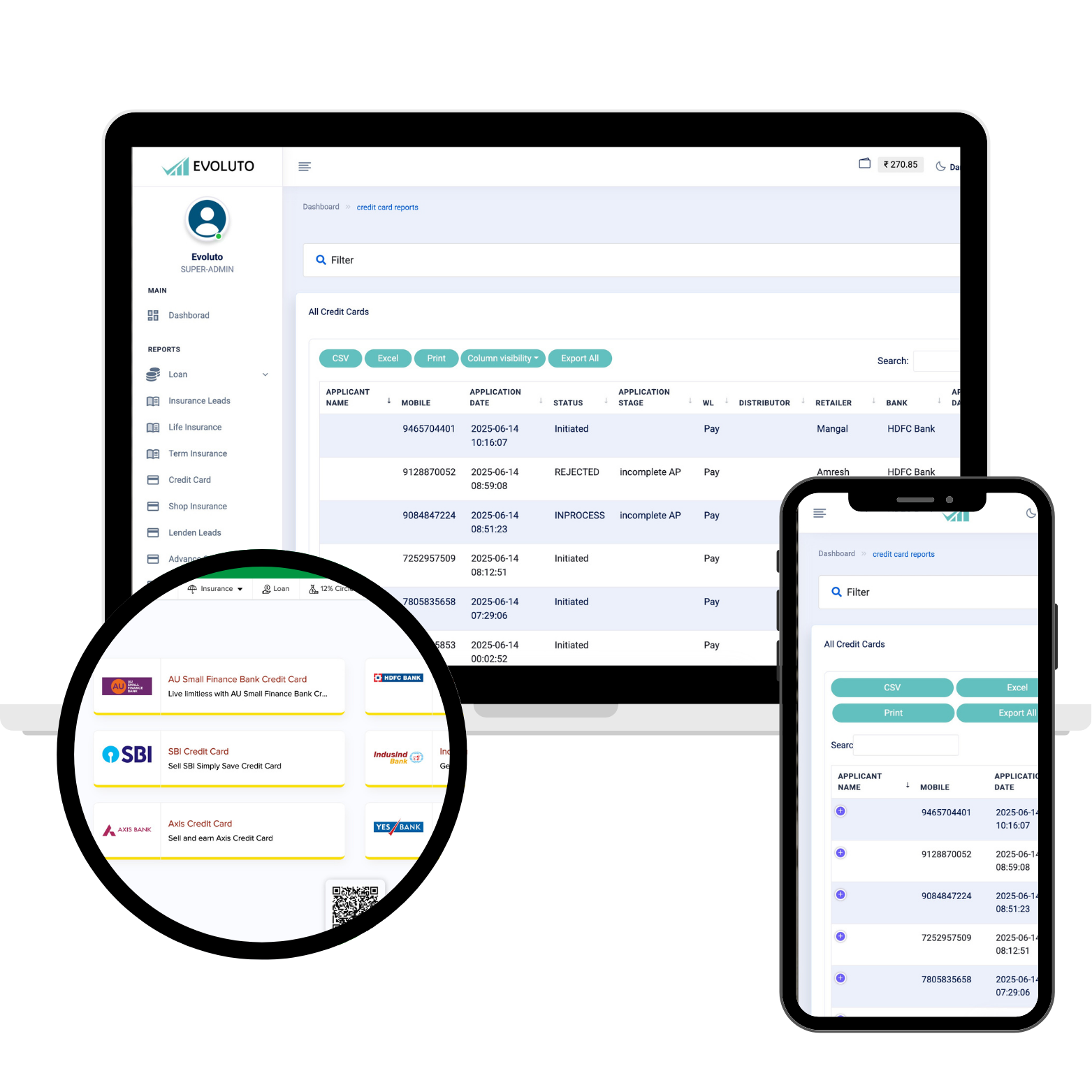

Credit Card Software

Maximizing Your Credit Card Experience

Your Credit Card Software is not just a platform, it's a comprehensive solution designed to elevate your credit card experience. Here's an in-depth look at the advanced features that make our software stand out.