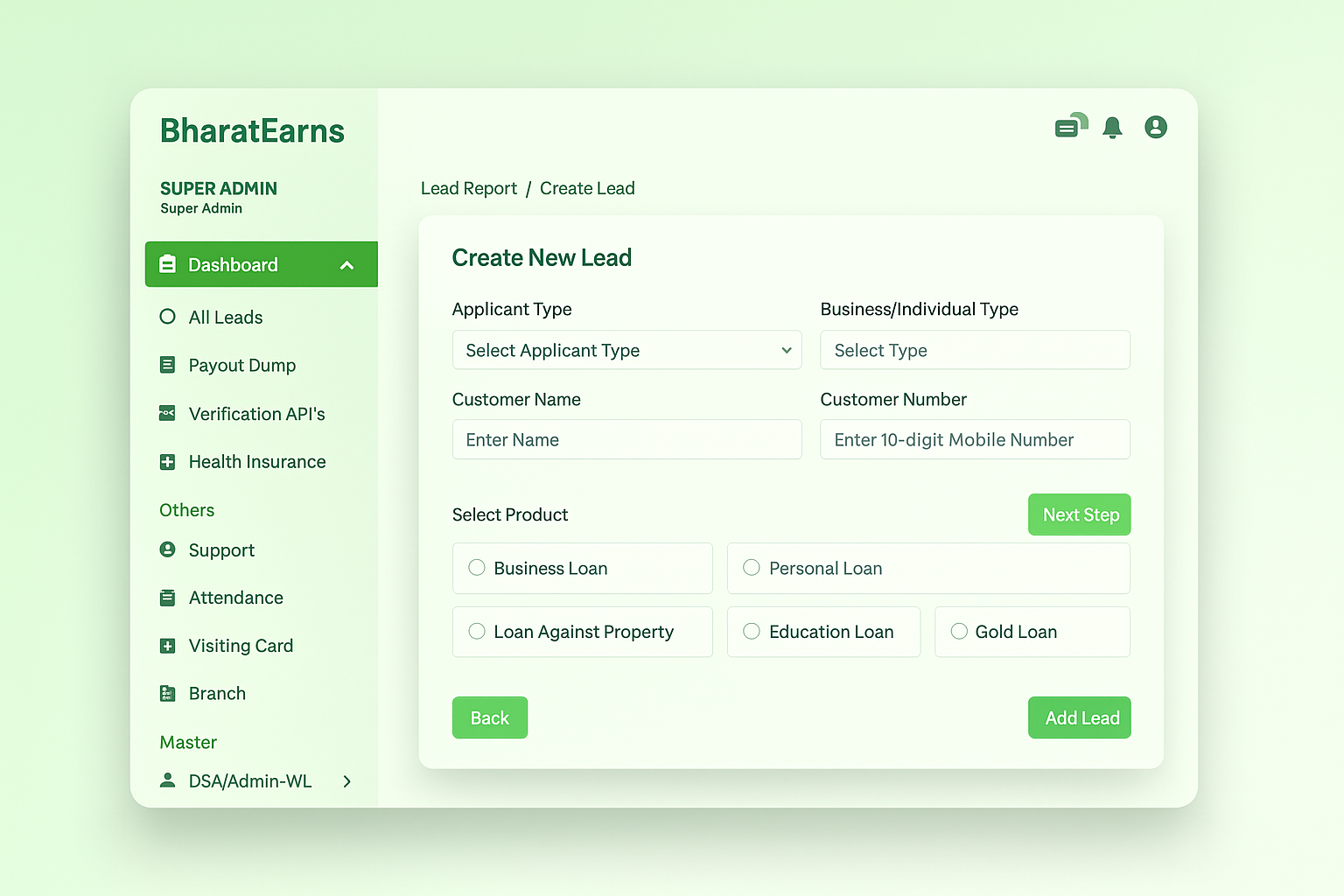

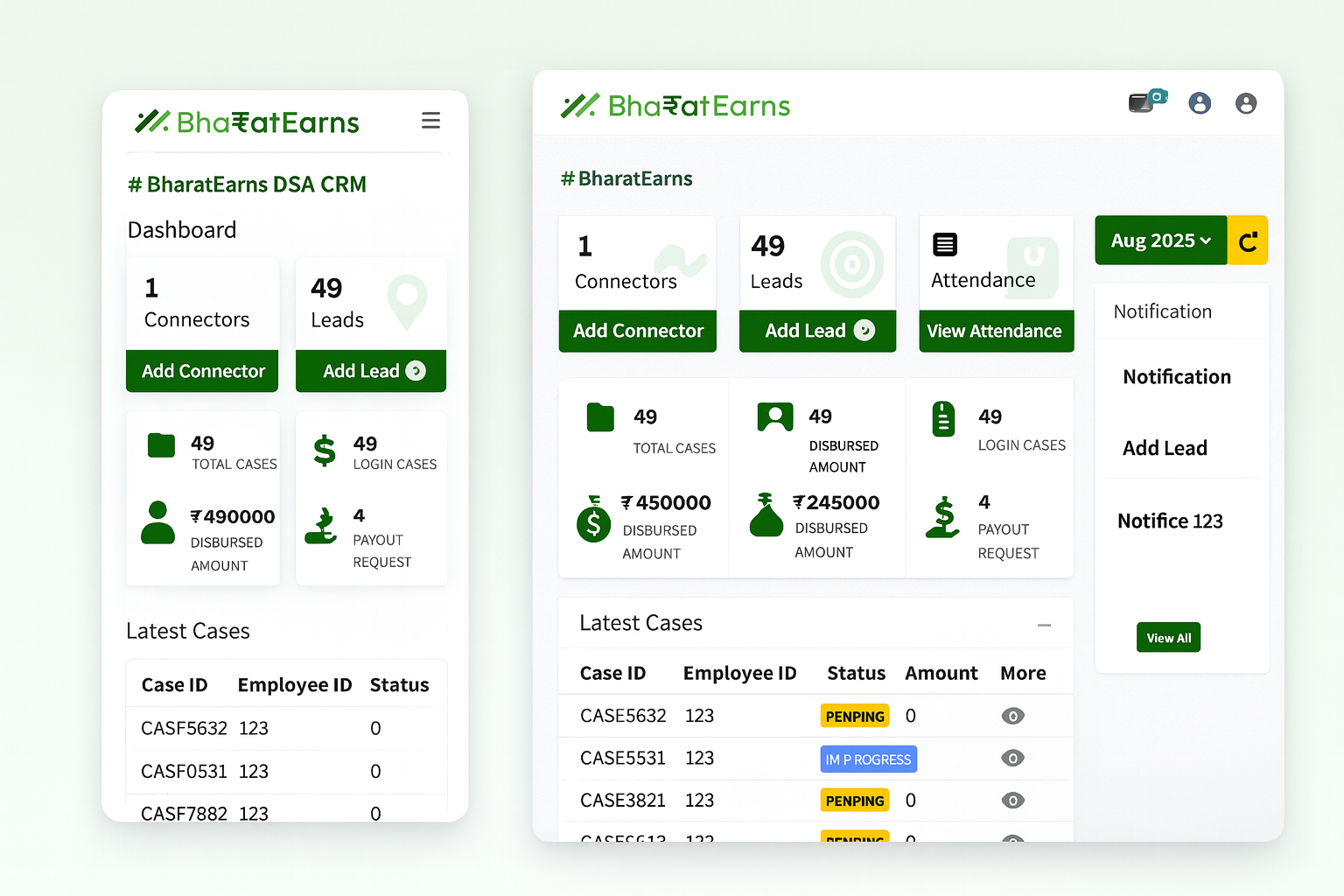

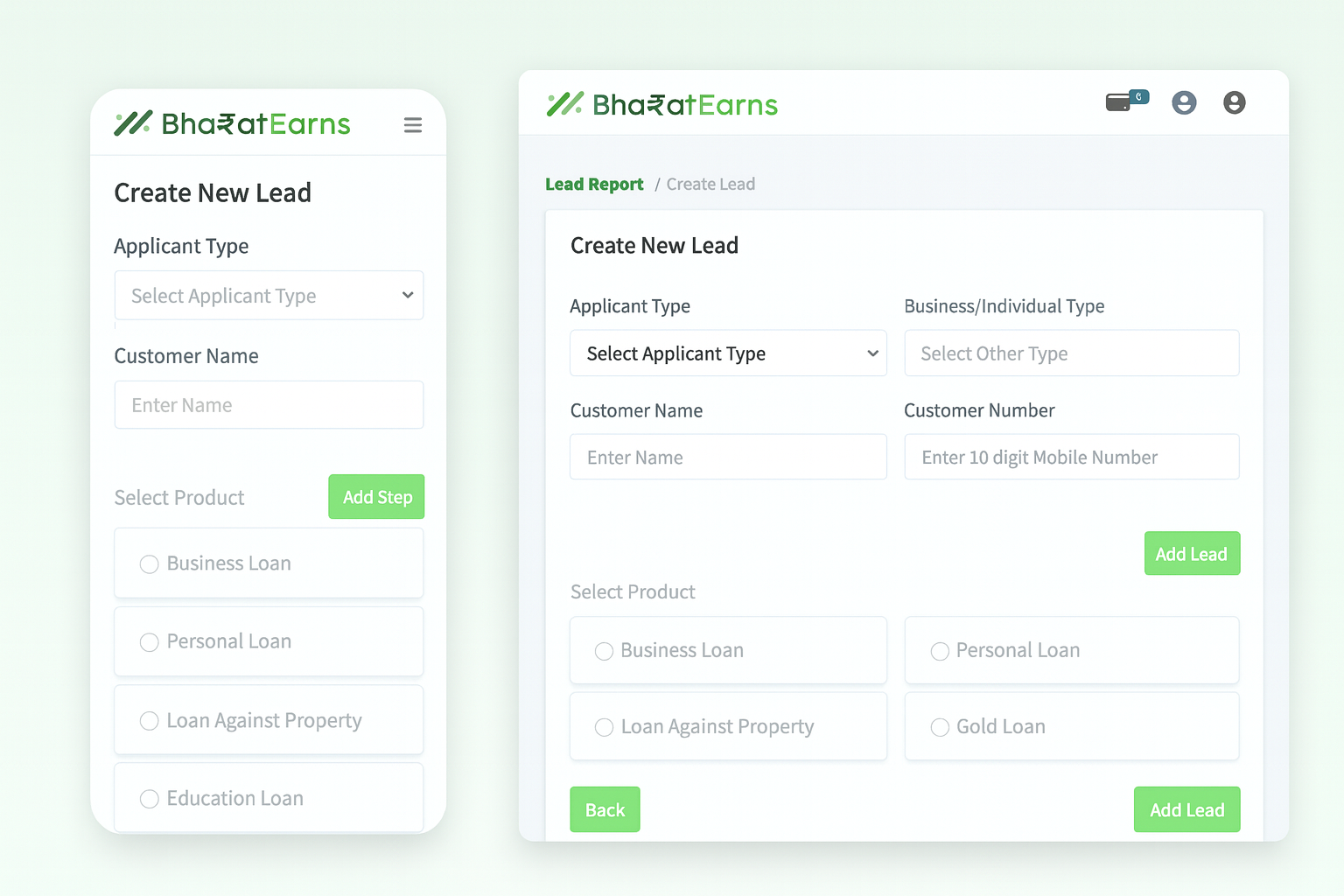

Introducing BharatEarns DSA CRM

Accelerate growth. Automate payouts. Close more loans.

Manage your entire lending business from a single, secure platform built for DSAs, loan aggregators and financial institutions. Faster lead-to-loan cycles, transparent partner payouts, and real-time analytics — so you scale profitably and compliantly.